House Of Reps Speaker Abass Decries Reckless Borrowing Under Tinubu As Debt Hits ₦149 Trillion

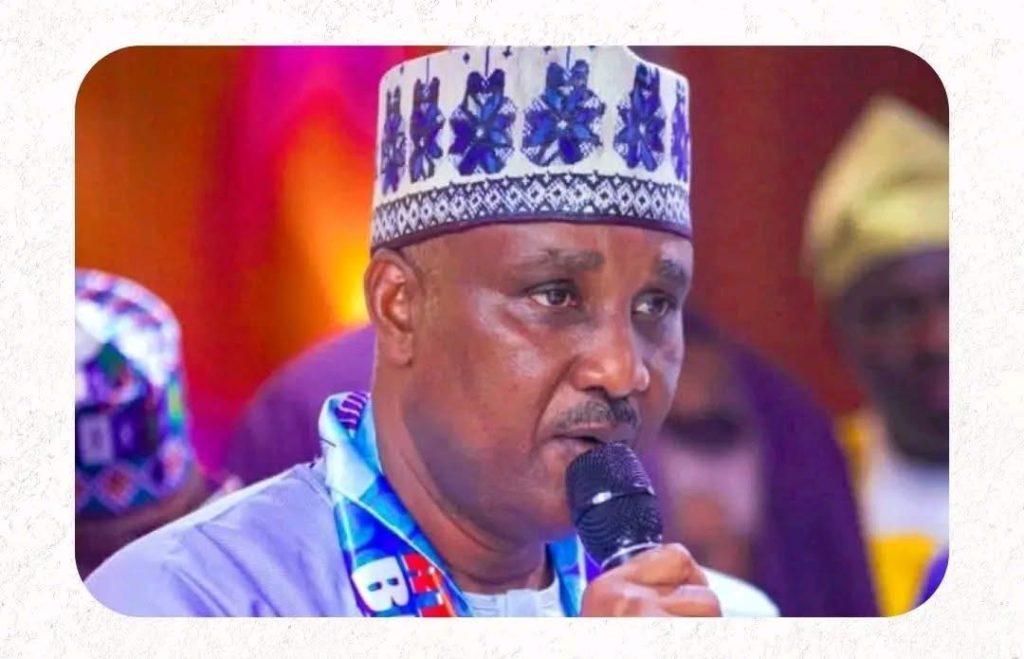

Speaker of the House of Representatives, Hon. Tajudeen Abass, has expressed deep concern over Nigeria’s rising debt profile, describing the continued borrowing under President Bola Ahmed Tinubu’s administration as “reckless and unsustainable.”

Abass, who spoke during plenary on Tuesday in Abuja, lamented that the nation’s total public debt has ballooned to ₦149 trillion, a figure he warned poses a grave threat to the economy and future generations.

According to him, while borrowing is sometimes necessary to stimulate growth, the current trend shows little evidence of fiscal discipline or corresponding infrastructural development to justify the mounting obligations.

“It is disturbing that despite the huge debt burden already hanging on the country, the Federal Government continues to accumulate more loans with minimal accountability. At ₦149 trillion, Nigeria’s debt is approaching a danger zone. We cannot continue to mortgage the future of our children,” Abass said.

The Speaker urged the executive arm of government to explore alternative revenue sources such as blocking leakages, expanding the tax net, and diversifying the economy, rather than over-relying on debt. He also tasked relevant committees of the House to intensify oversight of government borrowing and ensure compliance with fiscal responsibility laws.

Economic experts have similarly warned that Nigeria’s growing debt stock, coupled with high debt servicing costs, could erode available funds for critical infrastructure, healthcare, and education, leaving little fiscal space for meaningful development.

The latest figures from the Debt Management Office (DMO) show that domestic and external debts have surged, partly due to new loans contracted to finance the 2024 budget deficit and foreign exchange adjustments.

With inflation already at record highs and the naira under pressure, analysts caution that the nation’s borrowing spree, if unchecked, may plunge the economy into deeper crisis.